Understanding your potential annual income from an hourly wage involves more than just simple multiplication. This guide walks you through the factors influencing your yearly earnings, helping you calculate your potential take-home pay and make informed decisions.

Deconstructing the $46/Hour Figure: Beyond Simple Math

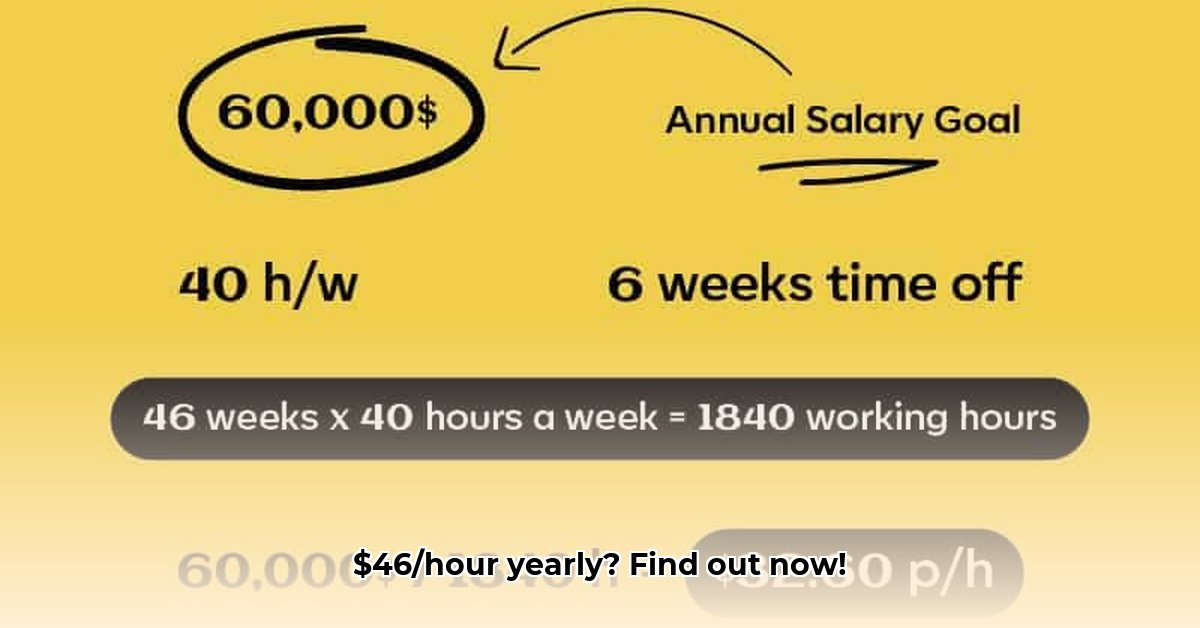

Curious about what a $46/hour wage translates to annually? The answer isn't a single number, but rather a range depending on several key variables. Let's explore them.

The Basic Calculation: A Starting Point

A straightforward calculation, assuming a standard 40-hour workweek and a 50-week work year (allowing for two weeks of vacation), yields a gross annual income of $92,000 ($46/hour * 40 hours/week * 50 weeks/year). But this is just the tip of the iceberg. Your actual income will be significantly influenced by other factors.

The Crucial Variables: Overtime, Benefits, and Taxes

Several critical factors impact your final take-home pay. Let's examine them:

Overtime: Overtime pay, often 1.5 or even double your regular rate, significantly boosts earnings. Even a few extra hours weekly adds substantially to your annual income. How much extra could you earn with 10 hours of overtime per week?

Benefits: Employer-provided benefits—health insurance, retirement contributions (401(k) matching), paid time off (PTO)—add considerable value beyond your base salary. These are not included in the initial $92,000 estimate. "A comprehensive benefits package can add $10,000 or more annually to your total compensation," says Dr. Emily Carter, Professor of Economics at the University of California, Berkeley.

Taxes: Federal, state, and local income taxes, along with Social Security and Medicare taxes, reduce your net income. Using an online tax calculator (like the one from Calculator.net) tailored to your location and filing status provides a much more accurate estimate of your take-home pay. What percentage of your gross income might typically go towards taxes?

Location: The purchasing power of your income varies greatly by location. A $92,000 salary in a smaller town offers a different lifestyle compared to the same salary in a high-cost-of-living city.

Industry: Salary ranges vary across industries. Researching comparable jobs in your area provides valuable context for the $46/hour rate.

Illustrative Scenarios: Painting a Clearer Picture

To illustrate, here are a few scenarios based on different levels of overtime and benefit packages (remember these remain estimates):

| Scenario | Weekly Overtime Hours | Estimated Annual Benefit Value | Estimated Gross Annual Income | Estimated Net Annual Income (Range) |

|---|---|---|---|---|

| Standard 40-Hour Workweek | 0 | $5,000 | $92,000 | $65,000 - $75,000 |

| Moderate Overtime (5 hours) | 5 | $7,000 | $110,000 - $115,000 | $78,000 - $88,000 |

| Significant Overtime (10 hours) | 10 | $10,000 | $138,000 - $145,000 | $95,000 - $108,000 |

Note: These net income ranges are estimations. For exact figures, consult a tax professional or use a comprehensive tax calculation tool.

Actionable Steps and Advice

Here’s how to approach calculating your annual income from a $46/hour wage realistically.

1. Calculate Gross Annual Income: Use the formula: Hourly Rate * Hours/Week * Weeks/Year

2. Estimate Overtime Pay: Multiply overtime hours by your overtime rate and add to step 1.

3. Account for Benefits: Add the monetary value of your benefits package to your gross income (steps 1 & 2).

4. Estimate Taxes: Use an online tax calculator to determine your approximate tax liability.

5. Calculate Net Annual Compensation: Subtract estimated taxes from your total gross compensation (step 3).

Advice for Job Seekers: Consider the complete compensation package, including benefits and potential overtime, when evaluating job offers. Negotiate!

Advice for Employers: Offer competitive compensation and benefits packages to attract and retain top talent.

The Bottom Line: Holistic Financial Planning

While this guide provides valuable estimates, your actual income depends on multiple factors. Remember to factor in unexpected expenses, savings goals, and long-term financial planning. Consult with a financial advisor for personalized guidance. A $46/hour wage offers significant earning potential, but careful planning maximizes your financial wellbeing. 1Calculator.net Salary Calculator